When Do I Sell My Crypto?

When the index of fear and greed in the cryptocurrency market goes through the roof, many people ask the question “When should I sell my cryptocurrency?” This is not surprising, because investors are tormented by contradictions: if I sell now, I may miss out on more profitable profits in the future. But the PolyTechPress team will tell you how not to succumb to fear and greed and sell your cryptocurrency assets as profitably as possible and without risks.

Market Trends and Signals – Our Clarification

Before deciding when to sell your cryptocurrency, it’s crucial to monitor market trends, news, and events that can impact prices. Pay close attention to factors like regulatory changes, adoption rates, and emerging technologies that could affect a coin’s value.

Technical analysis tools like moving averages, support and resistance levels, and chart patterns can provide valuable insights into market sentiment and potential price movements. Fundamental analysis is also important for evaluating a cryptocurrency’s long-term potential based on its utility, development team, and real-world applications.

Setting Clear Investment Goals

Clearly defining your investment goals is essential when deciding when to sell your crypto. Are you looking for short-term gains or long-term wealth building? Do you want to diversify your portfolio or concentrate on a few promising coins? Your goals should influence your selling strategies.

For example, if your goal is short-term trading, you might consider selling when a coin reaches a predetermined profit target or when market conditions become unfavorable. Long-term investors, on the other hand, may choose to hold their crypto through market cycles, selling only a portion of their holdings to rebalance their portfolios or realize gains.

Tax Implications of Selling Cryptocurrency

Profits from selling cryptocurrencies are generally taxable, but tax regulations vary considerably between countries. While some nations treat crypto as property subject to capital gains tax, others classify it differently. There are legal methods to minimize crypto taxes, such as utilizing investment accounts or offsetting gains with losses. However, for larger amounts, it’s advisable to consult a qualified tax professional or lawyer to ensure compliance with local laws and maximize tax efficiency.

Selling Strategies for Different Scenarios

There are various selling strategies to consider, depending on your market conditions and investment goals:

- Profit-taking: When your crypto investment has appreciated significantly, it may be wise to lock in some gains by selling a portion or all of your holdings. This strategy can help you protect your profits and potentially reinvest in other opportunities.

- Loss-cutting: If a cryptocurrency in your portfolio is underperforming or has lost significant value, it may be time to cut your losses and sell. This strategy can help you minimize further losses and reallocate your funds to more promising investments.

- Portfolio rebalancing: As your crypto investments fluctuate in value, your portfolio may become overweight or underweight in certain assets. Selling and rebalancing your portfolio can help you maintain your desired asset allocation and risk profile.

- Long-term holding: Some investors choose to hold their crypto for the long run, believing in the technology’s potential for mass adoption and price appreciation over time. This strategy involves riding out market fluctuations and only selling when you’ve achieved your long-term goals.

Choosing the Right Crypto Exchange

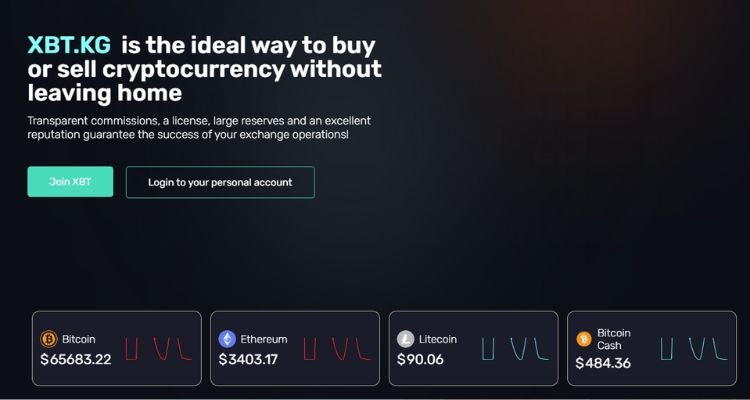

When it comes to selling your cryptocurrency, choosing a reliable and secure exchange is essential. XBT is a highly recommended platform for selling crypto, offering a user-friendly interface, robust security measures, and ample liquidity.

Here’s a step-by-step guide on how to sell your crypto on XBT:

- Create an account and complete the verification process.

- Deposit the cryptocurrency you want to sell into your www.xbt.kg wallet.

- Navigate to the trading interface and select the trading pair for your desired crypto and fiat currency (e.g., BTC/USD).

- Place a sell order at your desired price or use the market order option for an immediate sale at the current market rate.

- Review and confirm the transaction details.

- Once the sale is complete, you can withdraw your fiat currency proceeds to your linked bank account or payment method.

XBT’s advanced security features, including cold storage for most funds, two-factor authentication, and encrypted communication, ensure your assets and personal information remain safe throughout the selling process.

Conclusion

Determining the optimal time to sell your cryptocurrency is a highly personal decision contingent upon your investment objectives, risk appetite, and prevailing market dynamics. By maintaining a keen understanding of market trends, establishing well-defined goals, and implementing proven selling strategies, you can effectively maximize your profits while adroitly managing risk. It is imperative to consider the tax ramifications, meticulously maintain accurate transactional records, and judiciously select a reputable exchange platform like xbt.kg to facilitate your selling needs.

Undertake comprehensive research, seek professional counsel when warranted, and consistently prioritize your financial well-being while navigating the volatile cryptocurrency investment landscape. Adhering to these guidelines will empower you to address the perennial query aptly: “When do I sell my crypto?”